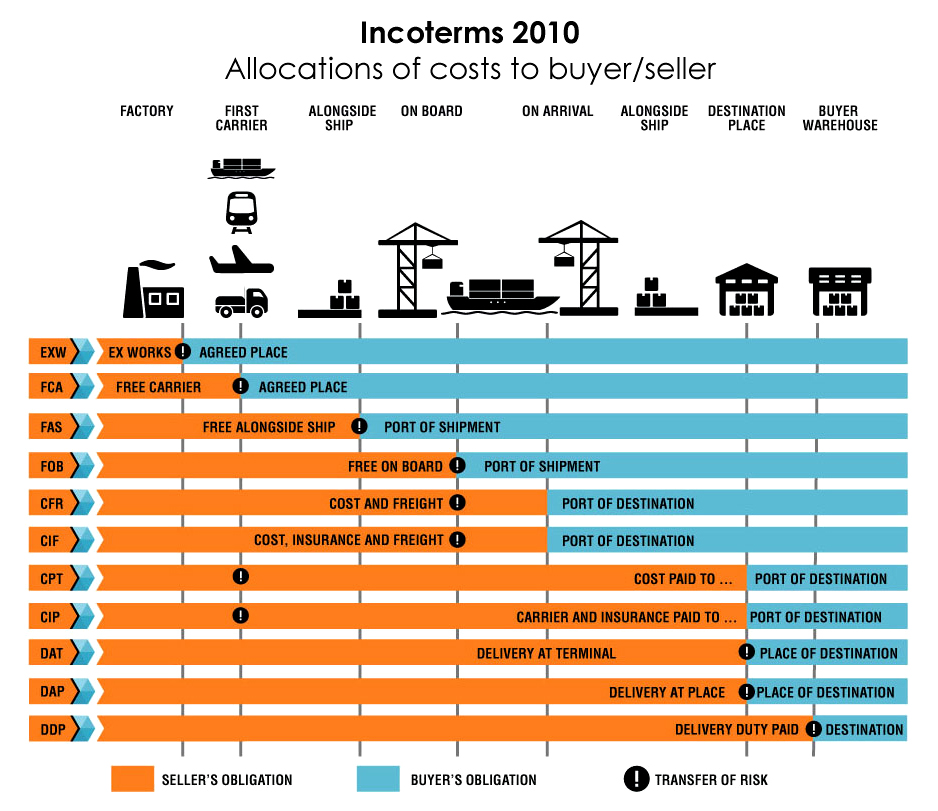

Allocations of costs to buyer/seller

EXW – Ex Works

The seller makes the goods available at his/her premises.

This term places the maximum obligation on the buyer and minimum obligations on the seller.

The Ex Works term is often used when making an initial quotation for the sale of goods without any costs included.

EXW means that a buyer incurs the risks for bringing the goods to their final destination.

The seller does not load the goods on collecting vehicles and does not clear them for export.

If the seller does load the goods, he does so at buyer’s risk and cost. If parties wish seller to be responsible for the loading of the goods on departure and to bear the risk and all costs of such loading, this must be made clear by adding explicit wording to this effect in the contract of sale.

The buyer arranges the pickup of the freight from the supplier’s designated ship site, owns the in-transit freight, and is responsible for clearing the goods through Customs. The buyer is also responsible for completing all the export documentation.

These documentary requirements may cause two principal issues.

Firstly, the stipulation for the buyer to complete the export declaration can be an issue in certain jurisdictions (not least the European Union) where the customs regulations require the declarant to be either an individual or corporation resident within the jurisdiction. Secondly, most jurisdictions require companies to provide proof of export for tax purposes.

In an Ex-Works shipment the buyer is under no obligation to provide such proof, or indeed to even export the goods.

It is therefore of utmost importance that these matters are discussed with the buyer before the contract is agreed. It may well be that another Incoterm, such as FCA seller’s premises, may be more suitable.

FCA – Free Carrier (named place of delivery)

The seller delivers the goods, cleared for export, at a named place. This can be to a carrier nominated by the buyer, or to another person nominated by the buyer.

It should be noted that the chosen place of delivery has an impact on the obligations of loading and unloading the goods at that place. If delivery occurs at the seller’s premises, the seller is responsible for loading the goods on to the buyer’s carrier. However, If delivery occurs at any other place, the seller is deemed to have delivered the goods once their transport has arrived at the named place; the buyer is responsible for both unloading the goods and loading them on to their own carrier.

FAS – Free Alongside Ship (named port of shipment)

The seller delivers when the goods are placed alongside the buyer’s vessel at the named port of shipment.

This means that the buyer has to bear all costs and risks of loss of or damage to the goods from that moment.

The FAS term requires the seller to clear the goods for export, which is a reversal from previous Incoterms versions that required the buyer to arrange for export clearance. However, if the parties wish the buyer to clear the goods for export, this should be made clear by adding explicit wording to this effect in the contract of sale. This term can be used only for sea or inland waterway transport

FOB – Free on Board (named port of shipment)

The seller must advance government tax in the country of origin as of commitment to load the goods on board a vessel designated by the buyer. Cost and risk are divided when the goods are sea transport in containers (see Incoterms 2010, ICC publication 715).

The seller must instruct the buyer the details of the vessel and the port where the goods are to be loaded, and there is no reference to, or provision for, the use of a carrier or forwarder.

This term has been greatly misused over the last three decades ever since Incoterms 1980 explained that FCA should be used for container shipments.

It means the seller pays for transportation of goods to the port of shipment, loading cost.

The buyer pays cost of marine freight transportation, insurance, unloading and transportation cost from the arrival port to destination. The passing of risk occurs when the goods are in buyer account.

The buyer arranges for the vessel and the shipper has to load the goods and the named vessel at the named port of shipment with the dates stipulated in the contract of sale as informed by the buyer.

CFR – Cost and Freight (named port of destination)

Seller must pay the costs and freight to bring the goods to the port of destination. However, risk is transferred to the buyer once the goods are loaded on the vessel. Insurance for the goods is NOT included. and This term is formerly known as CNF (C&F, C+F or CF)

CIF – Cost, Insurance and Freight (named port of destination)

Exactly the same as CFR except that the seller must in addition procure and pay for the insurance.

CPT – Carriage Paid To (named place of destination)

CPT replaces the venerable C&F (cost and freight) and CFR terms for all shipping modes outside of non-containerised seafreight.

The seller pays for the carriage of the goods up to the named place of destination.

Risk transfers to buyer upon handing goods over to the first carrier at the place of shipment in the country of Export.

The Shipper is responsible for origin costs including export clearance and freight costs for carriage to named place (usually a destination port or airport).

The shipper is not responsible for delivery to the final destination (generaly the buyer’s facilities), or for buying insurance. If the buyer does require the seller to obtain insurance, the Incoterm CIP should be considered.

CIP – Carriage and Insurance Paid to (named place of destination)

This term is broadly similar to the above CPT term, with the exception that the seller is required to obtain insurance for the goods while in transit.

CIP requires the seller to insure the goods for 110% of their value under at least the minumum cover of the Institute Cargo Clauses of the Institute of London Underwriters (which would be Institute Cargo Clauses (C)), or any similar set of clauses.

The policy should be in the same currency as the contract.

CIP can be used for all modes of transport, whereas the equivalent term CIF can only be used for non-containerized seafreight.

DAT – Delivered at Terminal (named terminal at port or place of destination)

This term means that the seller covers all the costs of transport (export fees, carriage, unloading from main carrier at destination port and destination port charges) and assumes all risk until destination port or terminal.

The terminal can be a Port, Airport, or inland freight interchange.

Import duty/taxes/customs costs are to be borne by Buyer.

DAP – Delivered at Place (named place of destination)

Can be used for any transport mode, or where there is more than one transport mode.

The seller is responsible for arranging carriage and for delivering the goods, ready for unloading from the arriving conveyance, at the named place.

Duties are not paid by the seller under this term (an important difference from Delivered At Terminal DAT, where the buyer is responsible for unloading).

DDP – Delivered Duty Paid (named place of destination)

Seller is responsible for delivering the goods to the named place in the country of the buyer, and pays all costs in bringing the goods to the destination including import duties and taxes.

The seller is not responsible for unloading.

This term is often used in place of the non-Incoterm “Free In Store (FIS)”.

This term places the maximum obligations on the seller and minimum obligations on the buyer.

With the delivery at the named place of destination all the risks and responsibilities are transferred to the buyer and it is considered that the seller has completed his obligations

Sea and Inland Waterway Transport

CFR: Cost and Freight.

CIF: Cost, Insurance, and Freight.

FAS: Free Alongside Ship.

FOB: Free on Board2.